Converting Taxable Capital into CharitableCapitalTM • Motivating Donors to Understand, Plan and Give

In order to respect wealth and maximize its use in helping successful families achieve their true financial and charitable objectives, it is important to understand that wealth breaks down into three forms of financial capital within the financial life support systemsTM of donors surrounded by the following financial engineering areas:

The three forms of financial capital are:

Personal Capital: Capital in which donors have control, use and ownership. This capital can be sold, consumed passed on to heirs or used to satisfy their giving desires.

Taxable Capital: The ownership, use and control of this capital must be given up and passed on to the U.S. Treasury for the general welfare of America and the world through ordinary income, capital gain taxation and, again at death . . . estate taxation.

CharitableCapitalTM: It is created through the conversion of taxable capital using the heart of tax law dating back to 1969. Donors can pin-point exactly what causes they wish to contribute to in satisfying their giving desires while generating substantial tax savings. Respecting that most non-profits are much more efficient than “government”, Congress created these laws to help motivate American citizens to give more; sidestepping governmental inefficiencies.

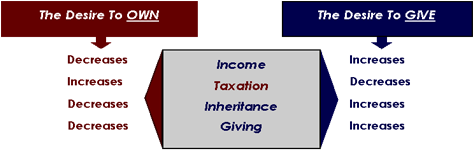

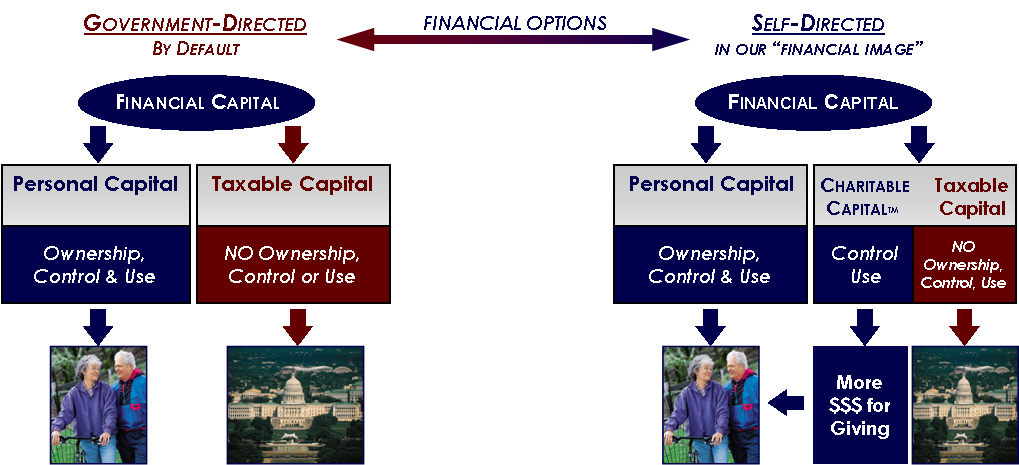

Although ownership is given up, this capital can be maintained while self-directing the contributions of Americans to society through custom designed planned giving. Charitable organizations and financial advisors have not been very effective in educating their donors and clients in how to convert Taxable Capital into CharitableCapitalTM in order to generate more Capital to use and control. As shown in the diagram below, the desire to have ownership can generate maximum taxation. However, the redirection of that desire can allow for increased income, decreased taxation, increased inheritance and increased giving.

Financial Capital - Ownership Versus CharitableCapitalTM Planning

The Cost of Ownership: Maximum Taxation

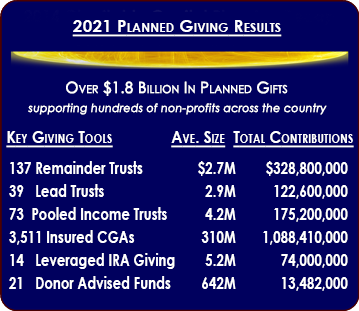

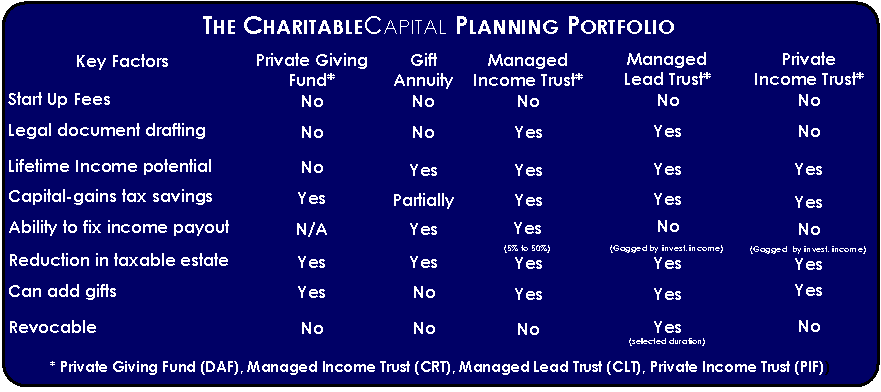

Why not assist donors by using the CharitableCapitalTM planning tools which Congress has made available for over 30 years. Planning tools such as:

Each of these tools can be used to generate substantial income tax deductions, cut away capital gains taxation and eliminate estate taxation while achieving the charitable “heart felt” desires of donors. As reflected in the following diagram, Americans are all philanthropists in one form or another. Either by default, government-directed, or by self-directing large portions of taxable capital into CharitableCapitalTM.

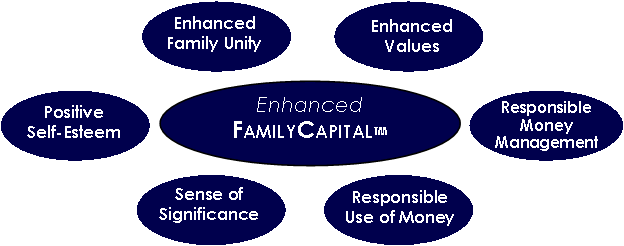

So, what type of philanthropists do donors and their families desire to be? Why not understand and respect the opportunities and pitfalls which surround the financial life support systemsTM of donors, use tax law effectively and take an intelligently planned course of action in accomplishing their needs, concerns and objectives. Such an approach can allow donors, their families and future generations to experience the incredible joy of CharitableCapitalTM planning while enhancing FamilyCapitalTM.

The Third Form of Financial Capital - CharitableCapitalTM

Enhancing Donor Relationships

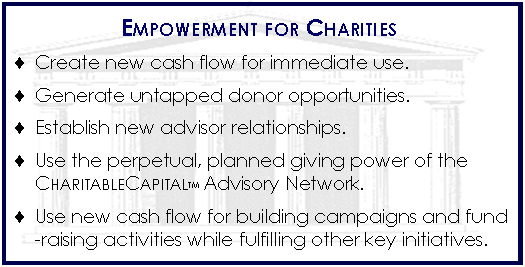

Empowering Charities to create and use new planned giving $$$ immediately .

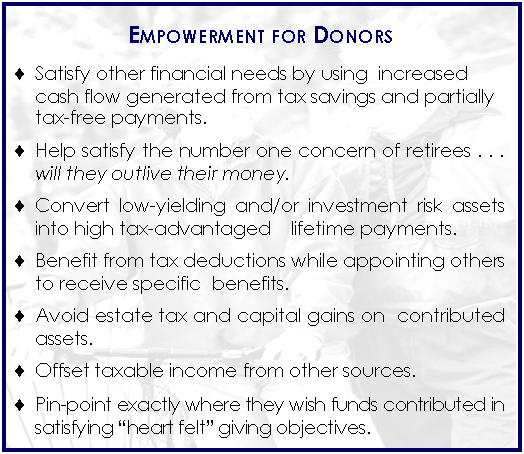

Empowering Donors to create and use new cash flow to satisfy other financial needs.

|

Regional Advisor/Charity Alliances Across The Country • Monthly and quarterly planning and training meetings. • Access to coaching, marketing and advanced case design. • Provide planning tool illustrations and proposals. • Supply marketing and educational materials: Full color booklets, brochures, articles, letters, flyers,

|

|